Dec 04 2025

/

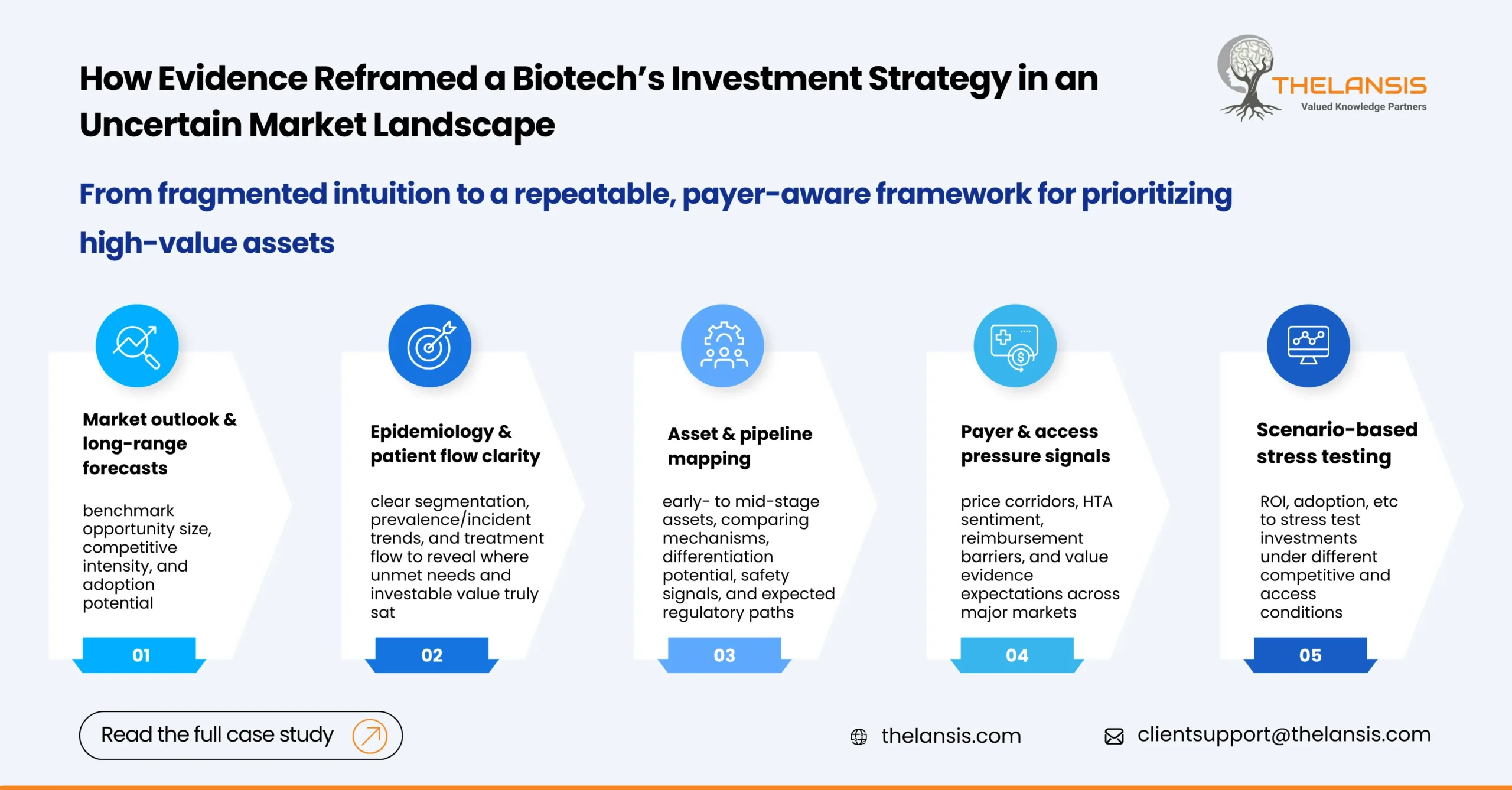

Optimizing Biotech Investment Strategy in an Uncertain Market Landscape

Introduction:

A US-based mid-size biotech firm was preparing for its upcoming investment cycle to broaden its therapeutic area focus. The team had strong scientific instincts but lacked a unified, evidence-based approach to compare opportunities across disease areas, evaluate commercial risk, and pressure-test assumptions in volatile market conditions. Their existing datasets were scattered, inconsistent, and not structured to support quick, high-stakes investment calls.

Objective:

To build a sharper, data-anchored investment strategy that could:

- Identify high-potential assets with a clearer view of risk, timelines, and their alignment with the payer expectations

- Bring consistency to how the firm compares market opportunities across therapy areas

- Anticipate shifts in disease burden, spending, competition, pricing, and access that could influence long-term value

Approach:

We worked closely with the partners to redesign how they sourced, validated, and applied insights to their decision process. This included:

1. Market Lens:

Developed focused market outlooks and long-range forecasts across priority diseases to help them benchmark opportunity size, competitive intensity, and adoption potential.

2. Epidemiology & Patient Flow:

Built clean, structured epidemiology models with clear segmentation, prevalence/incident trends, and treatment flow mapping to reveal where unmet needs and investable value truly sat.

3. Asset & Pipeline Mapping:

Reviewed the landscape of early- to mid-stage assets, comparing mechanisms, differentiation potential, safety signals, and expected regulatory paths.

4. Payer & Access Signals:

Highlighted price corridors, HTA sentiment, reimbursement barriers, and value evidence expectations across major markets, enabling the firm to understand long-term pressure on asset returns.

5. Scenario Planning:

Ran multiple scenarios (ROI, adoption, etc) to stress test investments under different competitive and access conditions.

Outcome:

The venture team gained a structured, repeatable framework for screening and prioritizing opportunities, grounded in real-world evidence rather than intuition alone. Within the first quarter, they:

- Narrowed their investment shortlist from 18 to 6 assets with strong value potential

- Re-allocated capital toward two therapy areas previously considered “high-risk,” backed by clear evidence on unmet need and payer openness

- Accelerated diligence timelines because internal debates shifted from “what do we think?” to “what does the evidence show?”

Most importantly, the partners walked into their next investment round with greater confidence, sharper conviction and a clearer view of where market uncertainty created opportunity rather than hesitation.