Nov 28 2025

/

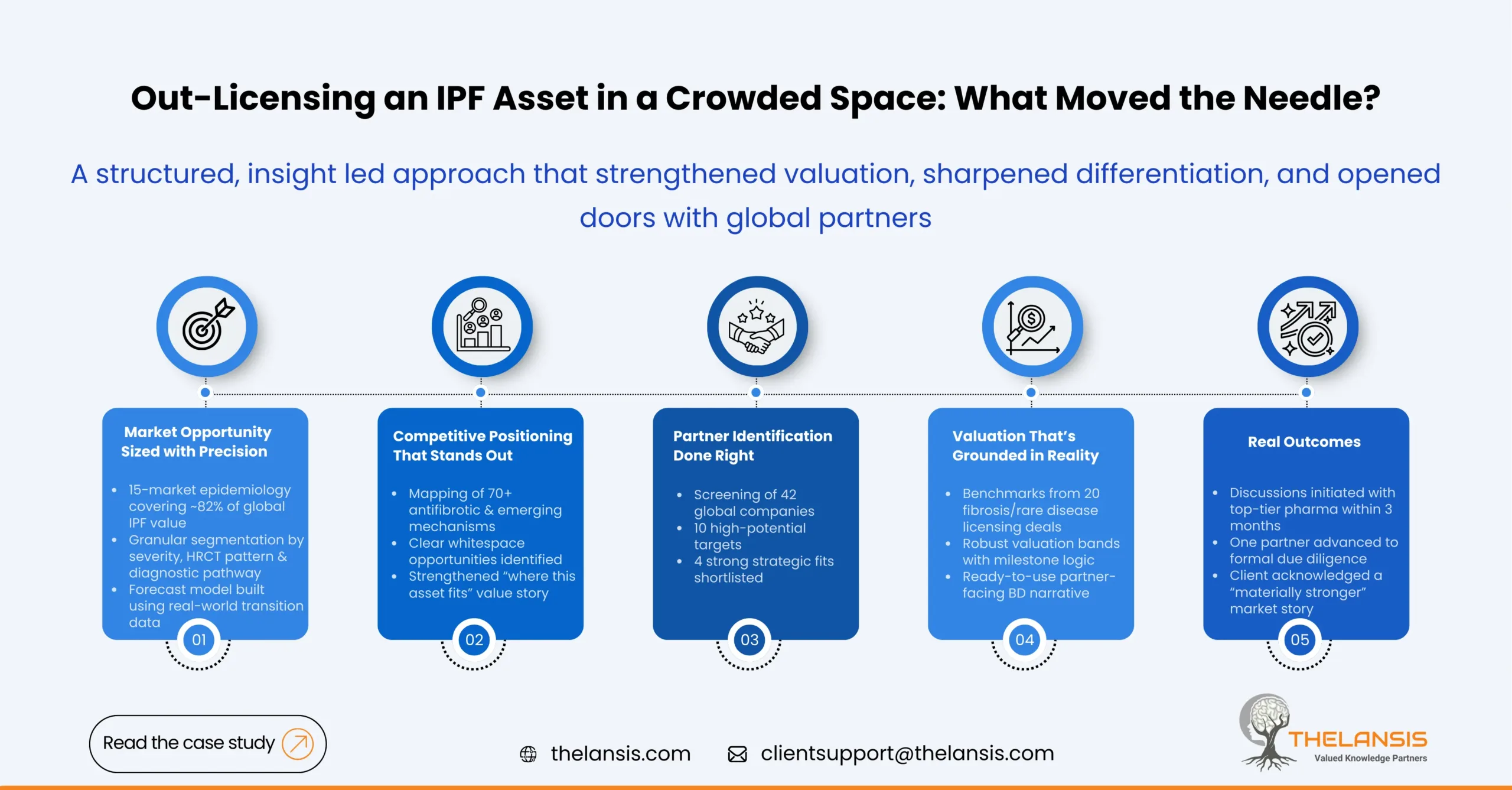

How Thelansis Supported a Mid-Sized Biopharma Company in Out-Licensing Their Novel IPF Asset

Introduction:

During 2024, a mid-sized biopharma company from the European region was developing a novel systematic therapy for the treatment of IPF, seeking an evidence-backed structured partnership strategy, where EpiLansis played an instrumental role in validating the market assumptions, estimating the market potential, and identifying the right licensing partners across the US, EU, and Asia.

The company had generated promising Phase 1 safety data in 78 healthy volunteers and a small exploratory efficacy readout in a 26-patient cohort but lacked the internal bandwidth and commercial foresight to identify suitable partners, build a value narrative, and quantify the market opportunity across geographies.

Objective:

The engagement focused on four quantifiable outcomes:

- Size the commercial opportunity using updated epidemiology—providing market estimates for 15 geographies covering ~82% of the global IPF market.

- Map and benchmark 70+ competitive and pipeline candidates, emphasizing late-stage antifibrotic mechanisms.

- Shortlist potential licensing partners from an initial pool of 42 companies, prioritizing 8 with a strong strategic fit.

- Strengthen the asset valuation & narrative with deal benchmarks from 20 relevant fibrosis/ rare disease licensing deals (2018–2024).

Approach:

1. Detailed Epidemiology break-up & robust ROI model

Using EpiLansis and custom modelling, Thelansis delivered granular epidemiology for IPF across the US, EU5, Japan, China, and emerging APAC markets.

- Prevalence and incidence estimates segmented by disease severity, HRCT patterns, and diagnostic pathways.

- Transition and progression modelling based on available real-world data.

- Country-wise variation in diagnosis rates and treatment uptake to derive realistic forecast assumptions.

This allowed the team to size the addressable population with higher precision than the client’s internal models.

2. Competitive Landscape & Mechanism Mapping

Thelansis conducted an exhaustive review of:

- Late-stage antifibrotic agents (e.g., TGF-β, LOXL2, YAP/TAZ pathways).

- Early-stage mechanisms that could become future competition by the time the client’s asset reaches the market.

- Key learnings from discontinued trials in IPF, which helped shape a defensible positioning for the asset.

This produced a clear “where the asset fits” narrative and showed five whitespace opportunities.

3. Partner Screening & Prioritization

A structured screening framework was used to score 42 potential licensees across:

- Pulmonary or fibrosis-focused portfolios

- Capability in rare lung diseases

- Recent licensing behavior

- Regional strategic priorities

- Appetite for co-development vs. full out-licensing

This resulted in a tiered list of 10 high-potential partners and a refined short-list of 4 companies with strong strategic alignment.

4. Deal Benchmarking & Narrative Development

Thelansis built comparable deal analyses for fibrosis and rare respiratory assets (Phase 1–2 stage) and modeled indicative licensing value ranges with milestone structures.

A partner-facing deck was created summarizing:

- Clinical rationale

- Epidemiology-backed opportunity

- Clear competitive whitespace

- Deal valuation band anchored in real benchmarks

This material was then aligned with the client’s scientific and business development leadership for outbound engagement.

Outcome:

Within three months of completing the engagement:

The company initiated discussions with three top-tier global pharma partners identified in the shortlist.

- One partner requested a detailed scientific exchange and later proceeded to a formal due diligence review.

- Feedback from initial outreach emphasized that the epidemiology and market narrative “materially strengthened” the company’s positioning compared to earlier communication attempts.

- The refined valuation framework helped the client negotiate from a stronger standpoint, avoiding undervaluation for an early-stage asset.

Thelansis’ involvement enabled the client to move from an informal, unstructured out-licensing effort to a data-driven, partner-ready commercialization strategy, significantly increasing the asset’s visibility and perceived value in a competitive IPF landscape.