Jan 27 2026

/

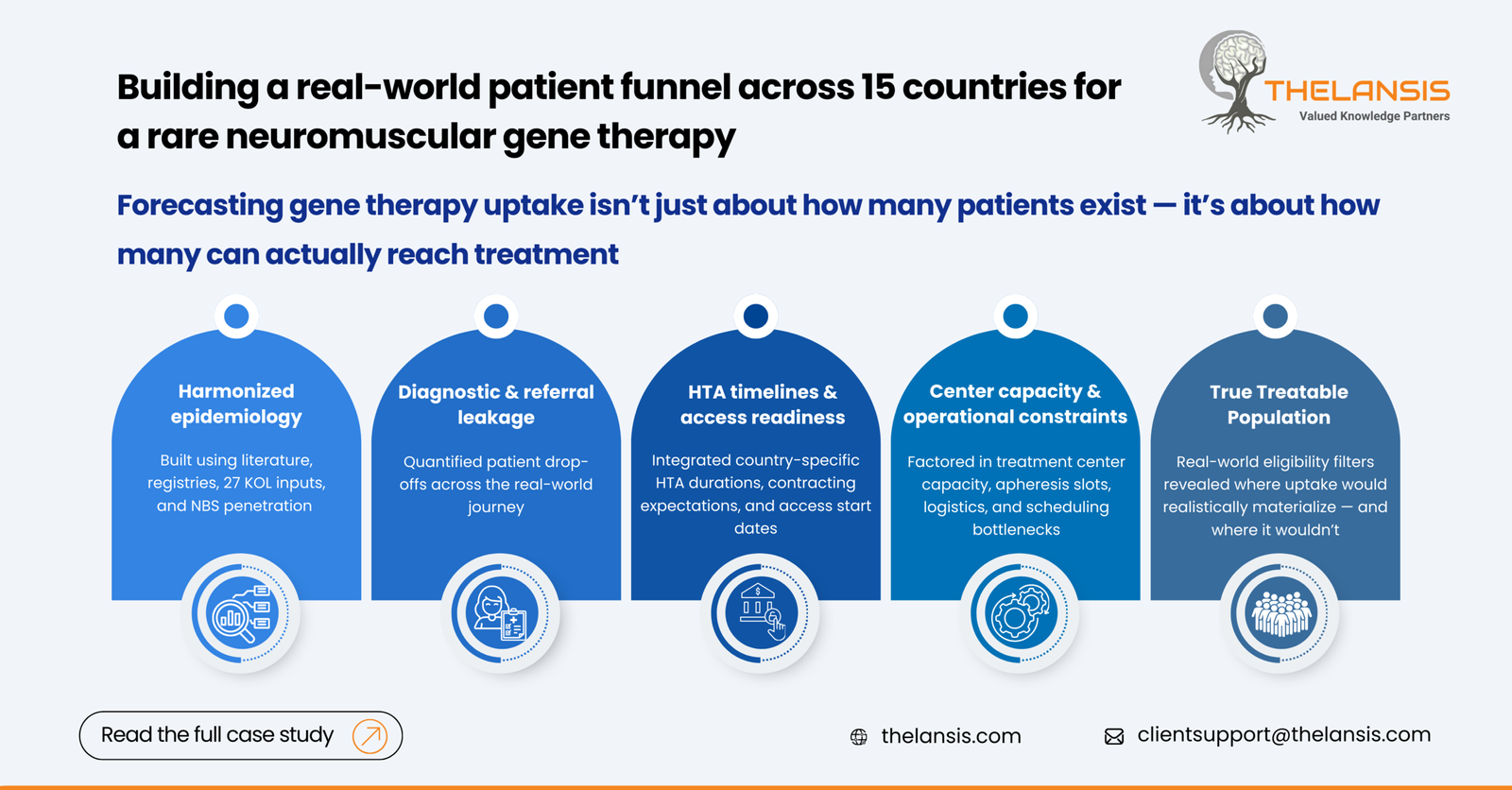

Building a Global Patient Funnel to Predict Uptake for a Gene Therapy Across 15 Countries

Context:

A global biotech developing an ex-vivo gene therapy for a rare neuromuscular disorder engaged Thelansis to build a cross-market patient funnel and uptake forecast. The therapy was approaching regulatory submissions in the US, EU5, and select APAC markets.

While early clinical data showed durable functional gains and reduced hospitalization burden, the commercial challenge was more structural:

- The disease lacked consistent epidemiology across markets

- Diagnostic rates varied from >70% in Germany to <25% across several APAC markets, driven by limited NGS & enzyme testing access

- Payers were already signaling demand for outcomes linked contracting, making precise patient identification essential for budget-impact planning

The sponsor needed a unified, evidence-based model that could:

- Quantify the true “treatable” population across 15 markets

- Identify points of friction in the diagnostic and referral pathway

- Predict realistic therapy uptake under multiple access scenarios

The Challenge:

The client’s internal epidemiology and forecasting inputs came from different functions HEOR, medical, and commercial each using separate assumptions:

- Epidemiology ranges differed by up to 3–4x between teams

- No standardized definition of “eligible patient” existed (genotype, age limits, functional class)

- Several markets lacked structured data on pre-symptomatic screening, though newborn screening (NBS) pilots were underway in France, Japan, and Brazil

- Patient leakage points were not quantified (primary care → neuromuscular specialist → genetic confirmation → treatment center readiness)

This fragmentation made it difficult to justify pricing, anticipate payer review timelines, or support launch sequencing. We were asked to build a global patient funnel that moved beyond prevalence numbers and captured real-world conversion rates at each step of the journey.

Our Approach:

1. Establishing a Harmonized Epidemiology Framework

We first created a standardized disease model using:

- Published prevalence & incidence literature (2015-2024)

- National registries (e.g., TREAT-NMD, Orphanet)

- Input from 27 KOLs across neurology and genetic medicine

- Country-specific demographics and newborn screening penetration

This allowed us to define a core epidemiology baseline, with transparent assumptions that could be stress tested.

2. Mapping the Diagnostic to Treatment Funnel

For each market, we quantified the probability of a patient progressing through the following nodes:

- Symptom onset recognition

- Referral to a neuromuscular specialist

- Genetic confirmation (NGS or enzyme assay)

- Eligibility confirmation (phenotype/genotype filters)

- Referral to authorized gene therapy center

- Center capacity & scheduling constraints

Real-world leakage data came from:

- Claims datasets (US)

- Regional NGS testing hubs (EU5, Japan)

- Hospital system interviews (Korea, Brazil, Mexico)

Across markets, the largest gaps were observed at genetic confirmation, especially where testing is self-pay.

3. Incorporating Market Access and System Readiness

Because gene therapy adoption is tightly linked to payer and operational readiness, the model integrated:

- Expected HTA duration (e.g., NICE’s typical 9-12 months, HAS 6-9 months)

- Anticipated contracting models

- Capacity constraints at authorized treatment centers

- Cold-chain & apheresis logistics availability

Country-specific access “start dates” were layered onto patient funnel outputs to generate realistic adoption curves, not theoretical demand.

4. Scenario Modeling

We ran three primary scenarios:

- Base case: current diagnostic rates + expected HTA timelines

- Optimized diagnostic: improvement in referral & genetic confirmation

- Rapid access: accelerated approvals (e.g., Japan’s Sakigake-like pathways)

Each scenario produced a dynamic, country-level patient funnel that aligned clinical, access, and operational realities.

Key Insights & Outputs:

1. The Addressable Population Was Overestimated by 40–55%

- Initial internal estimates assumed nearly all diagnosed patients would be eligible

- After applying real-world eligibility filters (genotype, comorbidity, functional capacity), the treatable cohort reduced significantly

- Countries with higher misdiagnosis rates (e.g., India, Brazil) saw sharper corrections

2. Diagnostic Friction Varied Drastically Across Regions

- EU5 conversion from diagnosis – genetic confirmation averaged 78-85%

- APAC conversion ranged 20-45%, largely due to cost and limited specialist networks

- The US had high testing rates but higher leakage at the “authorized center access” step due to uneven geographic distribution

3. System Readiness Was the Real Bottleneck

- Even in high diagnosis markets, center capacity is limited year-1 uptake

- Italy and Japan had strong pipelines for apheresis/infusion centers, whereas Spain, Brazil, and

- Korea required an infrastructure ramp-up before treating the first patient

4. Uptake Curves Shifted Materially Under Different Scenarios

Compared to the base case

- Improved diagnostic pathways increased year-5 treated patients by 18-30%, depending on the market

- Accelerated access pathways in Japan and the UK pulled forward peak uptake by 6-9 months

Impact Delivered:

- The sponsor now had a reliable, defensible model integrating epidemiology, funnel conversion rates, and access readiness.

- The funnel framework supported country-level budget-impact discussions, especially when payers sought outcomes-based contracts.

- The model highlighted where the sponsor could expect early volume (US, Germany, Japan) vs. delayed adoption (Brazil, Korea, Mexico).

- Countries with the steepest funnel leakage now have targeted tactics—for example:

- Expanding subsidies for NGS testing

- Building referral pathways between primary care and neuromuscular centers

- Strengthening newborn screening advocacy where pilots already exist

- The insights guided site onboarding timelines, apheresis logistics, and cold-chain requirements per market.