Dec 04 2025

/

The US-UK Drug Pricing Deal: What It Means for Both Countries and the Global Market

For years, the United States and the United Kingdom have stood on opposite ends of the drug pricing spectrum. The US has historically allowed manufacturers to set list prices with relatively few constraints, while the UK’s NHS relies on strict cost effectiveness evaluations through NICE.

So when news broke that both countries were exploring a coordinated framework on drug pricing, it immediately caught the attention of the biopharma world.

This isn’t just another bilateral agreement. It signals a shift in how major markets might negotiate access, affordability, and innovation—all at once.

Let’s break down what this deal is really about, why it matters, and how it could reshape global pricing norms.

So, What Exactly Is the US-UK Drug Pricing Deal?

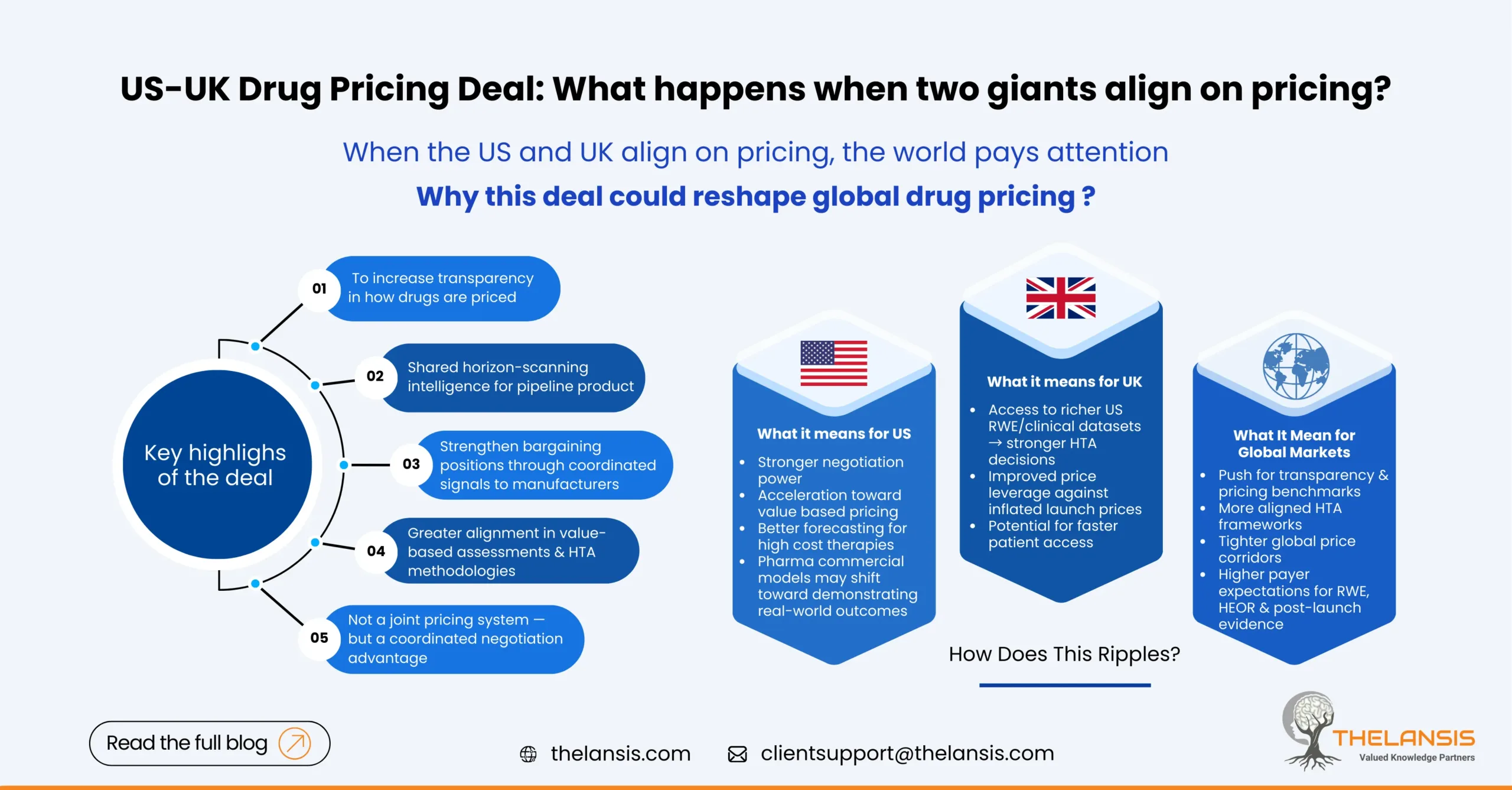

At its core, the agreement aims to:

- Increase transparency around how drug prices are set

- Share horizon-scanning intelligence for pipeline product

- Align approaches to value-based assessments and health-technology evaluations (HTAs)

- Strengthen bargaining positions through coordinated signals to manufacturers

Neither country is merging systems or creating a joint price. Instead, they’re trying to reduce information asymmetry, something pharma companies have historically benefited from.

Why Is This Deal a Big Deal?

Because for the first time, the world’s highest-spending pharmaceutical market (US) is learning from a value-based pricing system (UK), while the UK is gaining access to the US’s expansive real-world and clinical data ecosystem.

Together, they cover trillions in healthcare spending and represent markets that companies can’t ignore. If they coordinate, even loosely, it can create a gravitational pull that influences pricing conversations globally.

What Does It Mean for the US?

This deal nudges the US closer to structured, evidence-driven pricing. After years of debates, this could accelerate:

1. More Negotiation Power

The Inflation Reduction Act already opened the door for Medicare price negotiations. The US-UK collaboration could further strengthen the US’s ability to benchmark value and justify downward pressure on prices.

2. A Shift Toward Value-Based Healthcare

If the US borrows evaluation frameworks from NICE, we may see a larger push for real-world evidence, cost-effectiveness thresholds, and indication-based pricing. This reshapes commercial strategy for pharma companies in the US, possibly more than any legislation in recent memory.

3. Better Pipeline Forecasting

Sharing early insights on emerging therapies helps the US anticipate budget impact years in advance, something CMS has struggled with in fast evolving therapeutic areas like cell & gene therapy.

What Does It Mean for the UK?

While the UK is mostly seen as the value guardian, it stands to gain significant advantages too:

1. Access to US RWE and Clinical Data

Richer datasets strengthen UK health-economic evaluations and reduce uncertainties that often slow down NICE recommendations.

2. Improved Bargaining Leverage

With insights into US pricing trends and negotiation signals, the UK can challenge inflated launch prices more credibly.

3. Faster Access Pathways for Patients

The real intention behind this transparency push is quicker assessment, faster HTA decisions, and reduced delays in adoption through the NHS.

What Does It Mean for Pharma Companies?

Biopharma firms may need to rethink: global pricing corridors, launch sequencing, reference pricing strategies, evidence generation plans, and payer engagement playbooks.

If two of the world’s most influential markets begin aligning value frameworks, companies will face greater pressure to justify list prices with robust comparative effectiveness and real-world outcomes, not just clinical trial endpoints.

This could also accelerate the shift toward risk-sharing agreements, especially for high-cost therapies.

How Does This Ripples Across Other Countries?

Other markets, especially in Europe and the Asia-Pacific region are watching closely.

1. Stronger Push for Transparency

Countries that have long struggled with lack of visibility into US pricing may now gain indirect leverage.

2. Convergence of HTA Methodologies

A more harmonized value assessment approach can reduce duplication for manufacturers and tighten global price corridors.

3. Reference Pricing Impact

If US prices begin to show downward trends, countries using international reference pricing may see spillover reductions.

4. Rising Expectations for Evidence Packages

Global payers may demand more comprehensive RWE, HEOR studies, and post-launch commitments, echoing US-UK expectations.

What Does It Means for the Global Market?

When two giants coordinate, it sets the tone for everyone else.

We could see:

- Greater alignment on value-based pricing frameworks

- More global emphasis on cost-effectiveness thresholds

- Increased pressure on manufacturers to reduce launch price inflation

- Faster adoption of innovative therapies through shared evidence

- Tighter scrutiny on high-priced assets, specifically in oncology and rare diseases

This deal won’t rewrite global pricing overnight, but it could be the beginning of a long-term recalibration.

Is This the Start of a New Pricing Era?

Most likely, yes.

The healthcare world is becoming more connected, the demands for transparency are growing louder, and payers are no longer willing to negotiate in the dark.

The US-UK pricing deal serves as a signal: major markets are ready to coordinate, compare, and challenge drug prices with more sophistication than ever before.

For policymakers, it’s a strategic move.

For manufacturers, it’s a wake-up call.

For patients, it may eventually mean better access without impossible cost burdens.

Final Thoughts

Whether you’re a pharma executive, policymaker, or someone tracking global market access trends, the possible outcomes of this deal are worth paying attention to. It’s not just a bilateral agreement; it’s a blueprint for how major healthcare systems might collaborate going forward.

If global markets begin adopting similar partnerships, the industry could shift from fragmented negotiations to a more unified, value-driven pricing ecosystem.