Feb 05 2026

/

The IRA Phase 2: What 2026 Price Negotiations Mean for Innovators, Biosimilars, and Global Launch Strategy

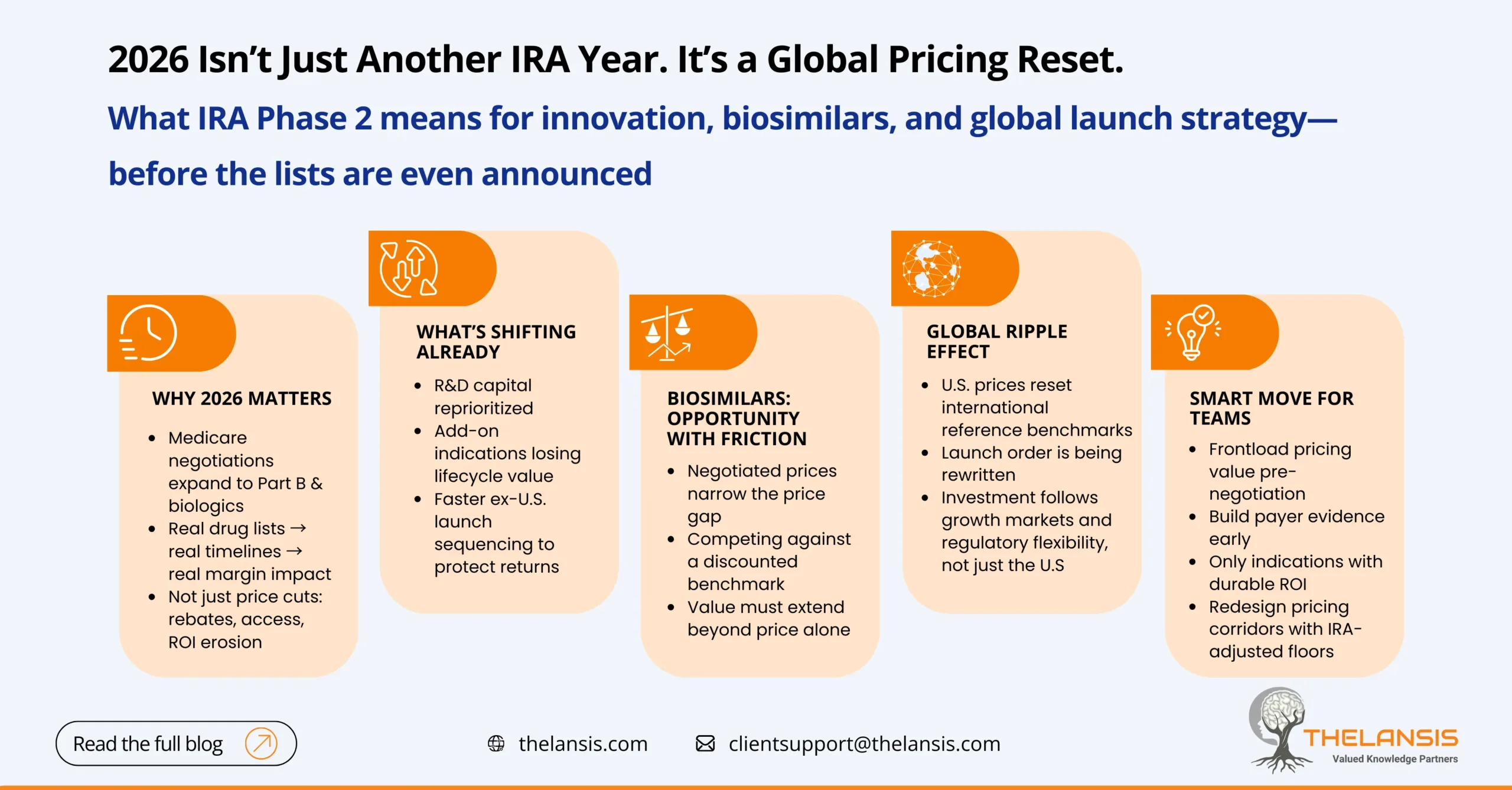

The Inflation Reduction Act (IRA) continues to reshape the U.S. pharmaceutical market. After the first list of 10 Medicare Part D drugs entered negotiations in 2023, the clock is now ticking toward Phase 2, when the next set of drugs will be named for 2026 price-setting. What initially felt like a distant policy shift is becoming a commercial reality, and the implications go far beyond U.S. Medicare pricing.

For innovative drug makers, biosimilar developers, and even companies shaping launch plans in Europe, Asia, and emerging markets, Phase 2 is signalling a new era: one where U.S. price controls create ripple effects across global strategy.

A Turning Point: Why 2026 Matters

Unlike the first negotiation wave, Phase 2 introduces new layers of complexity not just because more therapies will be included, but also because the selection criteria expand to include Part B drugs and biologics. This means monoclonal antibodies, oncology blockbusters, and multi-indication therapies are likely targets.

2026 also marks the point where manufacturers will have enough early clarity to adjust pricing architectures, clinical development priorities, and economic modelling. It’s no longer about planning for IRA generally; it’s about planning around real drug lists and precise timelines.

And here’s the nuance many headlines miss:

This isn’t only about net price cuts. It’s about margin disruption, rebating patterns, investment appetite, and access strategy.

For Innovators: The R&D Equation Is Already Moving

One of the most direct impacts of the IRA is on the R&D pipeline. Multiple global pharma companies have already reallocated capital because of IRA-linked erosion risks. For example:

Bristol Myers Squibb: discontinued development for the immuno-oncology therapy mavacamten in a non-cardiac indication, citing commercial viability pressures.

Novartis: signalled internal reprioritisation for late-stage programs where U.S. Medicare exposure creates vulnerability.

AstraZeneca CEO Pascal Soriot called the IRA an “innovation tax,” warning that it would reduce investment in certain biologics.

Why?

Because if Medicare pricing locks in sooner, lifecycle value shrinks, and suddenly, add-on indications or long-term biologics may no longer justify their cost of capital.

For innovators in 2026, the question isn’t whether prices will drop, it’s how to retain value:

- Accelerated launch sequencing

- Earlier ex-U.S. market monetisation

- Increased focus on cash-flow heavy indications

- Strategic value messaging to secure payer headroom pre-negotiation

Expect more companies to double down on orphan programmes, rare oncology, and precision medicine, categories temporarily shielded from IRA timelines.

For Biosimilars: Tailwinds and Turbulence

At first glance, IRA seems like a win for biosimilars. Price negotiation lowers originator value and may level the playing field. But there’s a twist:

Once negotiated prices are set, the spread between originator and biosimilar narrows. Instead of competing against a premium biologic, biosimilars could be chasing a discounted benchmark.

This means manufacturers will need:

- Sharper interchangeability strategies

- Portfolio consolidation

- Scaled commercial investment

- Real-world evidence to justify formulary differentiation

There’s also a timing nuance:

If innovators intentionally accelerate generic/biosimilar entry, they can avoid being selected for Medicare negotiation, reducing the advantage biosimilars are expected to gain.

In short:

IRA gives biosimilars an opportunity, but not a free ride.

Global Spillover: The World Is Watching U.S. Price Curves

One of the most underestimated consequences of Phase 2 will be its international impact. U.S. price changes do not stay in the U.S. for three reasons:

1. International Reference Pricing (IRP) Loops

Countries like Canada, Japan, South Korea, Brazil, and European markets reference U.S. pricing directly or indirectly during HTA and negotiation steps. Lower U.S. list prices will eventually lower international ceilings, even where policies are not formally linked.

2. Launch Sequence Recalibration

With IRA compressing years of free-market pricing, many manufacturers are already rethinking launch geography:

- Faster EU launch to secure HTA value before U.S. erosion

- Greater emphasis on APAC and LATAM for early cashflow

- Potential deprioritisation of U.S. launches in marginal indications

This is why we may see first launches shift to Germany, UK, or even China, depending on the therapeutic area.

3. R&D Migration Patterns

If IRA reduces investor appetite for high-cost biologics, clinical programs may accelerate in markets with stronger growth projections, like oncology in Asia, where regulatory pathways are evolving rapidly.

In short, U.S. Medicare decisions are shaping global pricing logic, without any direct foreign policy mechanism.

Real-World Pipeline Impact

Take oncology as an example:

Multiple late-stage PD-1/PD-L1 programs are being reassessed for commercial positioning because biosimilar entry timelines trigger Medicare selection sooner. If a leading checkpoint inhibitor is selected for negotiation in 2026 or 2027, subsequent line-extension launches may become economically neutral.

In cardiovascular disease, heart failure, and neurology, where patient volumes are high and economic margin compression is already influencing portfolio priorities.

The message:

2026 isn’t only a U.S. milestone. It’s a commercial turning point.

Preparing for Phase 2: What Companies Should Do Now

For Innovators:

- Build payer evidence early (QoL, PROs, real-world utility)

- Frontload pricing value pre-negotiation

- Consider accelerated ex-U.S. launch plans

- Reassess lifecycle commercial potential by indication

For Biosimilars:

- Strengthen value messaging beyond price

- Secure provider pull-through and patient support mechanisms

- Evaluate portfolio partnerships to scale market penetration

- Prepare for narrower price differentials vs originators

For Global Market Access Teams:

- Redesign pricing corridors with IRA-adjusted floors

- Stress-test launch forecasting against Medicare discount scenarios

- Update IRP and HTA models for U.S. spillover

The Bottom Line

IRA isn’t simply a U.S. pricing reform; it is reshaping global pharmaceutical economics.

Phase 2 in 2026 will open the next chapter: one where innovation incentives, biosimilar competition, and launch timing become more interdependent than ever.

Manufacturers who act now with data, agility, and realistic scenario planning will own the advantage. Those who wait for final price numbers may find the value gap widening too fast to close.