Feb 03 2026

/

The Collapse & Comeback of Digital Therapeutics: What the Industry Learned and Where It’s Going Next

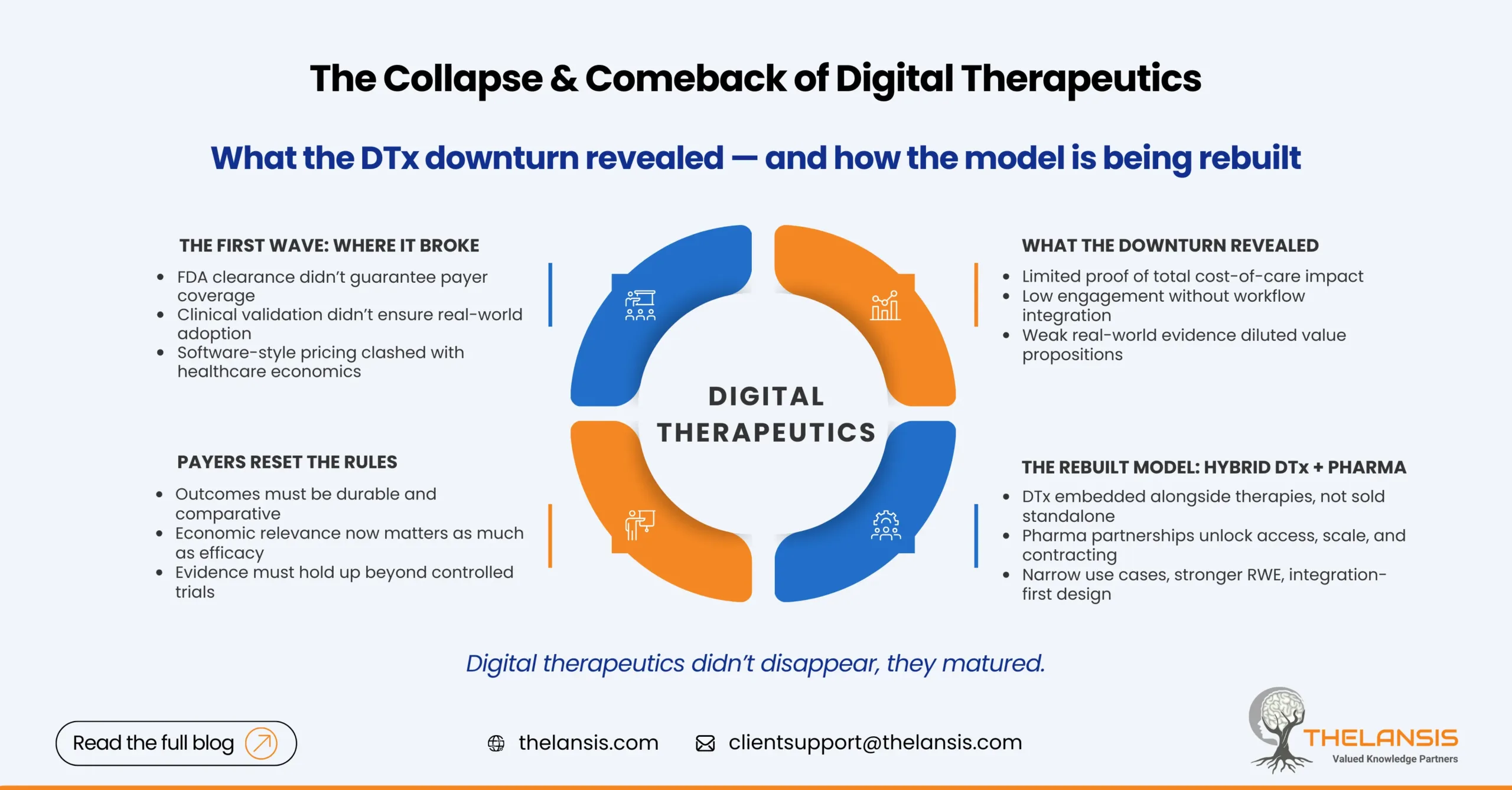

For a few years, digital therapeutics were treated as inevitable. Prescription apps would scale like software, improve outcomes like medicines, and disrupt chronic care economics along the way. Venture capital flowed, regulatory clearances multiplied, and early reimbursement wins were celebrated as proof that the model worked. Then reality intervened.

Pear Therapeutics’ bankruptcy in 2023 didn’t just mark the failure of one company; it exposed structural weaknesses across the DTx ecosystem. FDA clearance alone didn’t translate into payer coverage. Engagement at scale proved harder than expected. And many business models assumed a willingness to pay that health systems never truly committed to.

What followed wasn’t the end of digital therapeutics; it was a reset.

What the Downturn Actually Revealed

The post-Pear correction forced uncomfortable questions. Most importantly: what problem is DTx solving, and for whom? Many early products focused heavily on clinical validation but underinvested in commercialization design. Payers were being asked to reimburse recurring software costs without clear evidence that those tools reduced hospitalizations, medication spend, or long-term disease burden.

At the same time, operational friction was underestimated. Prescribing a digital therapy is not the same as downloading an app. Clinician workflows, EHR integration, referral pathways, and follow-up accountability all affect whether patients actually use and benefit from DTx solutions. Low real-world data utilization quietly eroded value arguments, even for clinically sound products.

The market correction was less about technology failure and more about misaligned assumptions.

Payers Raised the Bar and Clarified the Rules

If there is one lasting impact of the DTx downturn, it is this: payers now articulate their expectations more clearly. They want evidence that resembles what they evaluate in drugs, devices, or care programs, such as comparative outcomes, durability of effect, and economic relevance.

Short trials showing symptom improvement are no longer sufficient on their own. Coverage discussions increasingly revolve around questions such as: Does this reduce the total cost of care? Does it meaningfully improve adherence to existing therapies? Can benefits be demonstrated outside tightly controlled study environments?

This shift has pushed serious DTx developers toward stronger real-world evidence strategies, longer follow-up periods, and endpoints that align with payer decision-making rather than regulatory minimums.

The Rise of Hybrid DTx-Pharma Models

One of the most practical responses to these challenges has been the emergence of hybrid models linking digital therapeutics with pharmaceutical products. Instead of positioning DTx as standalone replacements, companies are embedding them as complements that support adherence, monitor response, or extend the value of existing therapies.

From a market access perspective, this makes sense. Pharma already has payer relationships, contracting mechanisms, and launch infrastructure. DTx companies bring patient engagement and data capabilities that pharma increasingly needs. Together, they can present a more coherent value story, particularly when digital tools are positioned as outcome enhancers rather than cost add-ons.

These partnerships also reduce commercial risk. Instead of building reimbursement pathways from scratch, DTx solutions can ride alongside established products, pilot within defined populations, and expand once value is demonstrated.

Why Digital Therapeutics are Coming Back — Quietly

The current phase of DTx growth looks very different from the first wave. There is less noise and fewer grand claims, but more discipline. Developers are prioritizing narrower use cases where digital intervention clearly changes behavior or care delivery, such as mental health, metabolic disease management, post-acute monitoring, and therapy adherence.

Regulators and HTA bodies are also more explicit about their evidence expectations, reducing uncertainty for companies willing to invest in high-quality studies. At the same time, health systems facing workforce shortages and rising chronic disease burden remain open to tools that demonstrably improve efficiency.

In other words, the demand never disappeared; only the tolerance for vague value propositions did.

What Market Access Teams Should Take Away?

The next generation of digital therapeutics will not succeed on innovation alone. Market access strategy must be built in early, not added after clearance. That means designing trials around payer-relevant outcomes, planning for real-world data collection from launch, and thinking carefully about pricing structures that reflect risk sharing rather than entitlement.

Integration matters as much as efficacy. Products that fit naturally into care pathways will outperform technically superior tools that create extra work for clinicians. And for many developers, partnerships with pharma, providers, or payers will be the fastest route to scale.

Closing Thought

The collapse of early DTx leaders was not a verdict on digital care. It was a reminder that healthcare adoption follows different rules than consumer tech. The comeback will be slower, more selective, and far more grounded in economics and outcomes.

That’s not a setback. It’s how sustainable healthcare innovation actually takes hold.