Nov 10 2025

/

Pharma Licensing 2025 and Beyond: Rethinking Strategic Partnerships for Long-Term Value

Introduction: Licensing as a Growth Engine in Pharma

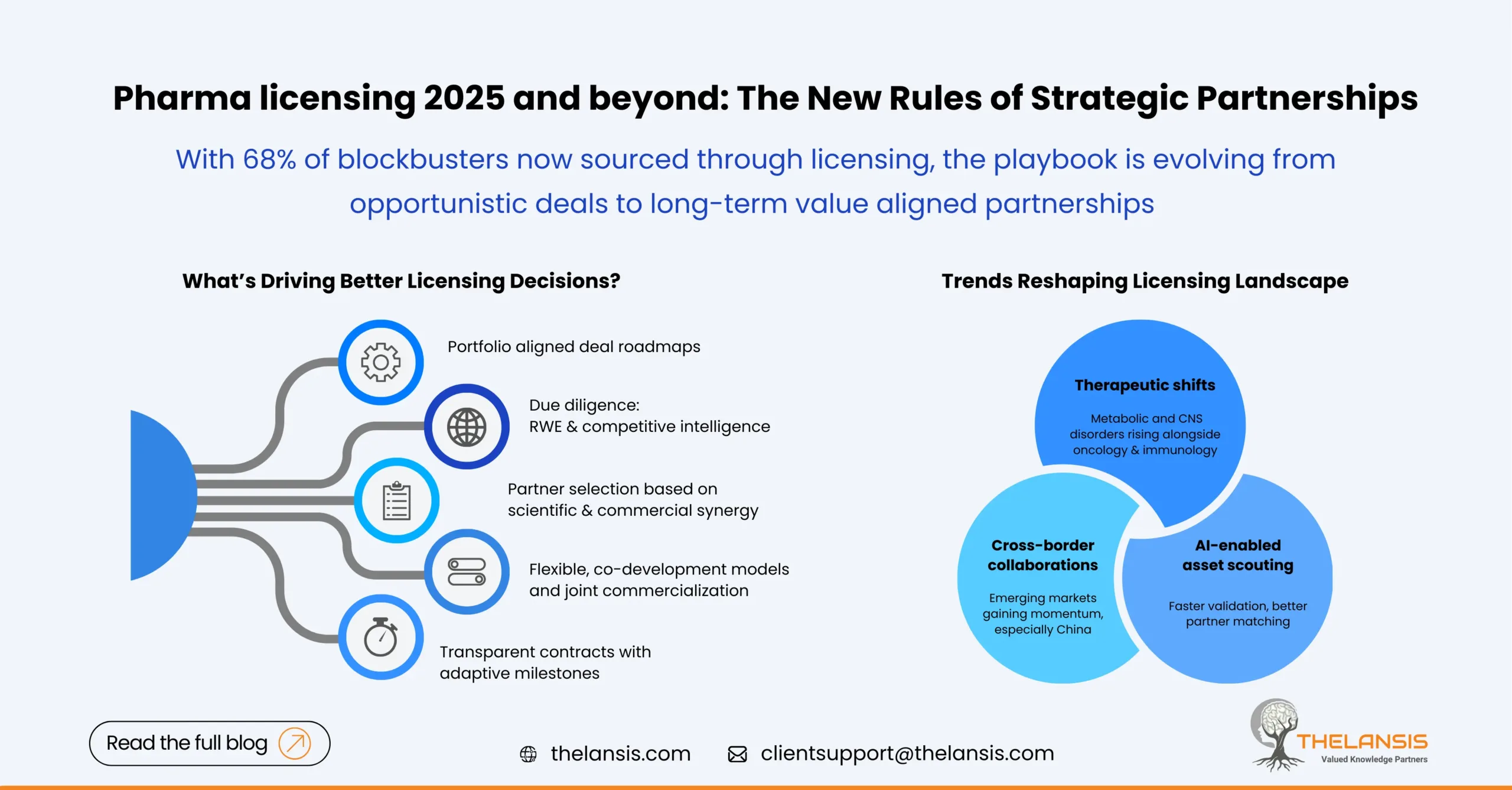

The global pharmaceutical and biotech companies are entering an era of collaboration, agility, and strategic alliances. As the R&D cost rises and regulatory timelines stretch, licensing deals have become essential levers for pharma companies to drive innovation and market expansion. Recent data indicate that 68% of blockbuster drugs are now sourced from licensing agreements instead of being developed in-house.

In 2025, the focus is shifting from transactional licensing to value-based partnerships. Pharmaceutical leaders are faced with a decision: should they acquire promising compounds from biotech companies or license out their own assets to enhance profits? As this choice will influence the future direction of their companies for years ahead.

Understanding In and Out Licensing

In-licensing allows companies to acquire external innovations, be it a molecule, technology, or platform, to strengthen their product pipeline without the high upfront R&D risk.

Conversely, out-licensing allows pharma innovators, mostly smaller biotech or research driven firms, to monetize their intellectual property by granting larger partners commercialization rights across markets.

Notable licensing deals from 2025

In March 2025, Novo Nordisk confirmed a deal with Lexicon for one of the experimental obesity drugs LX 9851, granting Novo worldwide rights to develop, manufacture, and commercialize the asset. The deal includes upfront plus near-term milestone payments of up to USD 75 million and a total potential value of around USD 1 billion

In July 2025, Ichnos Glenmark Innovation signed a global licensing deal with AbbVie for its lead investigational trispecific T-cell engager ISB 2001, which is in Phase 1 targeting multiple myeloma. Glenmark received upfront payment of USD 700 million with potential future milestones up to around USD 1.225 billion plus royalties on future sales.

Together, these models are creating a mutual ecosystem where both emerging biotechs and large pharmaceutical players can leverage each other’s strengths: scientific nimbleness and market scale.

Strategic Imperatives: How Pharma Can Navigate Licensing Decisions

Pharma leaders encounter multifaceted choices when deciding between in-licensing and out-licensing opportunities. In order to make sound decisions, they require more than just financial projections; they rely on structured evaluation of how each option fits the company’s strategy, resources, technology roadmap, and market potential.

- Align licensing with portfolio strategy: Instead of pursuing deals opportunistically, pharma companies are now building strategic licensing roadmaps. They are aligning licensing decisions with therapeutic focus, market expansion goals, and long term R&D vision to ensure that each partnership complements their broader corporate agenda.

- Strengthen due diligence with data: While portfolio gap analyses and market assessment are critical for successful deal making, companies should extend beyond basic forecasts. Incorporating real-world evidence, competitive benchmarking, and predictive analytics provides a sharper view of an asset’s true potential and risk profile.

- Identifying the ideal partnership: Choosing the right partner is a strategic move that determines the success or failure of any licensing deal. Companies should look for alignment in vision, scientific focus, and working structure. The strongest alliances are built by pairing complementary strengths, when one side brings innovation and the other offers commercialization expertise, it creates a balanced partnership.

- Build Collaborative Deal Structures: Traditional one-time licensing deals are being replaced by co-development agreements that keep both parties actively engaged in the product’s development and commercialization. Companies are now building flexible, hybrid models that combine licensing with co-marketing or joint commercialization. It’s a growing trend, roughly two-thirds of recent agreements include shared development responsibilities, a big uprise from 2021, showing how collaboration is reshaping the way pharma collaborations work.

- Structuring Contract to maximize Outcomes: A structured and well defined agreement between parties with agreed business terms is the cornerstone of successful licensing relationships. Apart from financial terms, it should outline key aspects like milestones, deliverables, IP ownership, and commercialization rights. When agreements are transparent and flexible, they give both sides room to adjust as clinical results or market conditions change, while keeping the focus on shared goals and value creation.

Key Trends Shaping Pharma Licensing in 2025

Shifting in Therapeutic Area Focus

Oncology, rare diseases, and immunology continue to dominate the licensing landscape 2025, but there’s a visible pivot toward neurology and metabolic disorders, areas where unmet needs and breakthrough science are intersecting.

AI-driven discovery and real world data are now enabling companies to identify and validate niche indications faster, influencing licensing decisions early in the pipeline.

Rise of Regional and Cross-Border Collaborations

Emerging markets in Asia-Pacific, LATAM, and the Middle East are becoming fertile grounds for regional licensing partnerships. Companies are out-licensing products to local partners who understand market access and complete the value chain of the sales and distribution network, while in-licensing localized products to diversify portfolios.

This cross-border model reduces time-to-market, and directs more inclusive access to therapies.

Digital and Data-Driven Licensing Decisions

Pharma licensing teams are increasingly integrating data analytics, AI scouting tools, and competitive intelligence to identify the right assets and partners. Digital licensing platforms are streamlining due diligence, contract negotiations, and post deal performance tracking, helping companies move from intuition driven to data backed deal making. As per a survey report by Life Science Partnership Council, these tools result in 27% higher satisfaction with alliance outcomes.

Sustainability and ESG-Linked Licensing

Licensing deals are also starting to incorporate environmental, social, and governance (ESG) clauses, especially in manufacturing and clinical operations. Investors and regulators are increasingly rewarding companies that align licensing strategies with sustainable business models.

The Future of Global Licensing Ecosystem

As the industry moves to the next phase of pharma licensing, there will be more complexities, that’s why co-creation and digital enablement have emerged as critical success factors.

As biopharma innovation decentralizes, companies will increasingly rely on strategic partnerships to access differentiated science, market reach, and data-driven insights.

Whether it’s a large pharma in-licensing a promising mRNA platform or a biotech out-licensing an AI-optimized molecule, the ability to create mutually beneficial, long-term alliances will define success.