Dec 02 2025

/

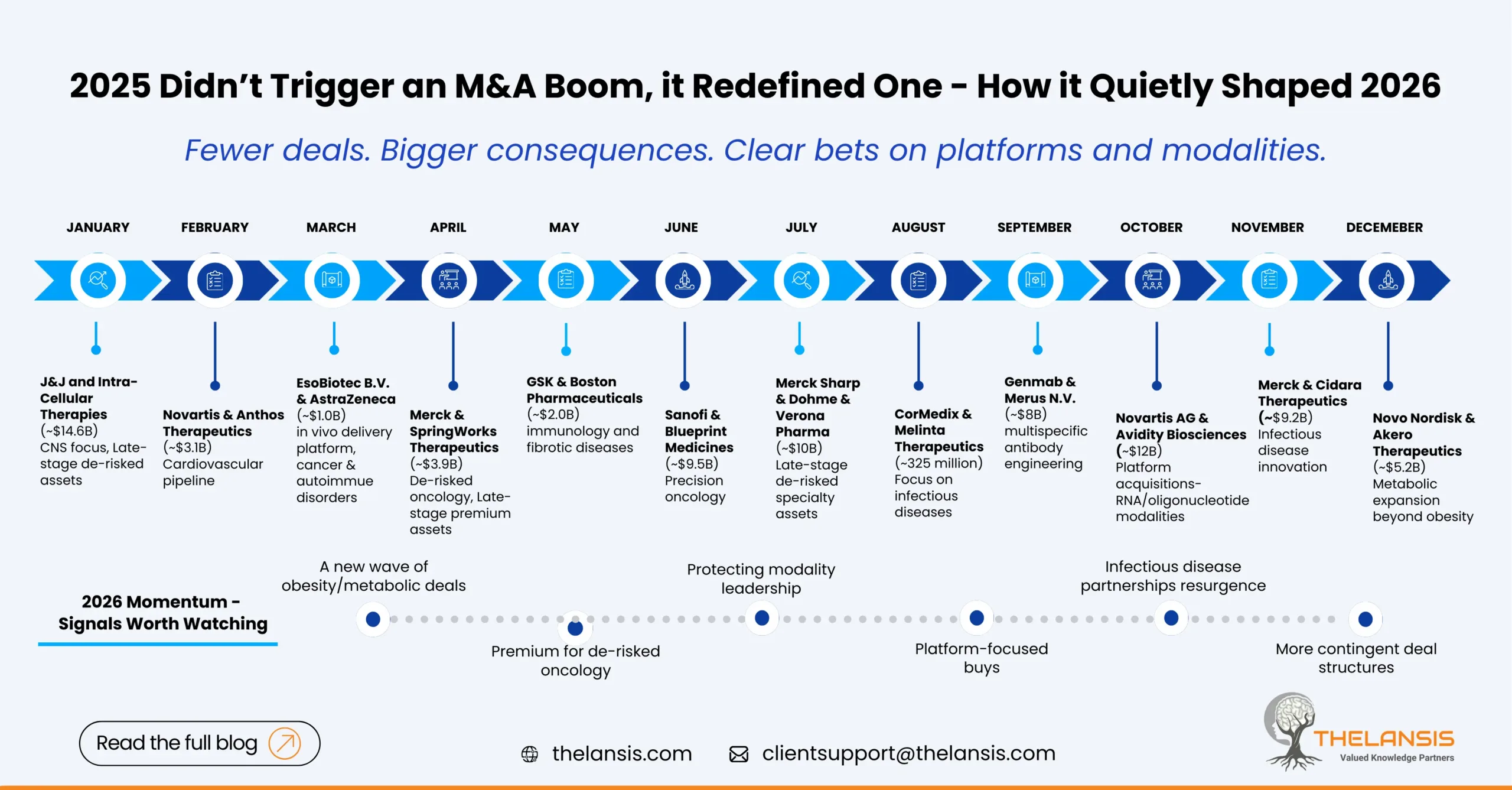

Mergers & Acquisitions in Pharma — What 2025 taught us and where the momentum is heading in 2026

2025 almost felt like pharma pressed a reset button on dealmaking. Money moved in patches, a handful of blockbuster deals grabbed headlines and reshaped competitive positions, while the broader market kept its cautionary posture. If you follow the industry, two impressions stand out: (1) big strategic buys kept happening, often to buy pipeline or platform breadth, and (2) dealmakers got picky, structuring transactions with milestones, royalties, and shared-risk components instead of all-cash rollups.

Below, we break down the most consequential moves of 2025, why they matter, and what 2026 is shaping up to become:

The headline deals and why they mattered

A few deals dominated the news cycle and importantly, will influence strategic behavior for years.

Johnson & Johnson → Intra-Cellular Therapies (~$14.6B)

J&J’s acquisition of Intra-Cellular was one of the largest pharma deals of the year, signaling continued interest in CNS and specialty assets that can expand a big company’s therapeutic footprint.

Novartis → Avidity Biosciences (~$12B)

Novartis pushed into RNA/oligonucleotide therapeutics with a multi-billion dollar move, underscoring that large pharmas are willing to pay top dollar for modality expertise that could unlock whole new categories of treatments.

Pfizer → Metsera (~$10B)

Pfizer used this acquisition to regain momentum in its post-COVID rebuild. Metsera’s metabolic and endocrine programs place Pfizer at the front edge of a fast-accelerating field adjacent to obesity therapeutics, a market reshaping pharma strategy globally.

Merck Sharp & Dohme → Verona Pharma ($10B)

This acquisition gave Merck a strong pulmonary/ respiratory asset in development for COPD, positioning the company in a space with high unmet need and significant commercial potential. It also strengthened Merck’s diversification strategy beyond oncology.

Sanofi (France) → Blueprint Medicines ($9.50 billion)

With this deal, Sanofi sharpened its precision oncology portfolio, picking up programs anchored in clear genetic drivers. It’s another sign of how strongly the industry is gravitating toward biomarker-led therapies and niche, high-value cancer indications.

Merck & Co. → Cidara Therapeutics ($9.2B)

The deal highlighted renewed interest in infectious disease innovations. Cidara’s immunotherapy next-generation platform evolved with a distinguished approach to develop and strengthen the antifungal and antiviral development, areas that had long struggled with pipeline stagnation.

Genmab → Merus N.V. (~$8B)

This was a landmark move in multispecific biologics, by integrating Merus’ multispecific antibody engineering platform, Genmab reinforced its position as a dominant player in next-gen oncology biologics.

Novo Nordisk → Akero Therapeutics ($5.2B)

As Novo Nordisk looks beyond GLP-1s, Akero’s NASH/steatohepatitis programs offered a strategic foothold in metabolic liver disease, a logical adjacency that could extend Novo’s dominance in metabolic care.

Merck KGaA → SpringWorks Therapeutics (~$3.9B)

The acquisition gave Merck KGaA, high-value, biomarker-driven oncology assets in late-stage development. It was a precision-oncology bet that provided commercial near-term upside and strengthened its competitive stance.

AbbVie → Capstan Therapeutics ($2.10 Billion)

One of the year’s clearest “capability buys,” it brought AbbVie a programmable in vivo cell therapy platform, an entirely new capability class. It signaled AbbVie’s push into next-generation genetic medicines and broadened its long-term innovation engine.

Roche → 89bio ($3.5 billion) / Poseida ($1.5 billion)

Roche’s dual acquisitions showcased a wide-angle expansion strategy: 89bio strengthened its metabolic and liver TA portfolio, while Poseida bolstered its cell therapy capabilities. Together, they indicated Roche’s intent to compete aggressively in areas where Lilly and Novo Nordisk have surged ahead.

The global pharma sector in Q3 2025 saw a sharp surge in deal value, and anlyst’s estimate that major transactions already account for roughly US $70 billion, with full-year totals likely to cross the US $100 billion mark. It’s not “bubble” territory, but it does reflect a meaningful concentration of capital behind strategic, high-conviction bets. What truly defined 2025 was a shift toward fewer but more consequential deals that will continue shaping competitive dynamics well into 2026 and beyond.

The Macro Shape of 2025: Fewer Deals, Bigger Implications

What stood out most was not how many deals were done, but which ones:

- Deal volumes dipped, but deal values rose — showcasing a sharp, deliberate focus.

- Buyers favored clinical validation over early discovery hype.

- Modalities like RNA therapy, multispecific antibodies, precision oncology, and in vivo cell engineering attracted disproportionate capital.

- A large chunk of 2025’s deal value came from mid-sized strategic buys, including Capstan, SpringWorks, Akero, 89bio, etc. These represent the “new normal” of pharma acquisitions: not trillion-dollar consolidations, but targeted purchases that shape competitive advantage for the next decade.

How 2026 Is Shaping Up — Signals Worth Watching

1. A new wave of obesity/metabolic M&A

Pharma giants are positioning around “life after GLP-1s,” targeting metabolic pathways, endocrine regulators, and combination therapies.

2. Platform moves will dominate

Expect more Capstan-like buys — assets that can generate multiple programs, not just one.

3. Late-stage de-risked oncology programs will trade at a premium

SpringWorks-type precision assets with clean biomarker-driven mechanisms will remain hot.

4. The return of infectious disease partnerships

Cidara may be a bellwether especially as AMR pressure and pandemic-preparedness funding shifts.

5. Companies will protect modality leadership

Genmab’s Merus acquisition hints that cutting-edge protein engineering platforms will be tightly guarded and heavily bid on.

6. Deal structure evolution — more contingencies

Expect milestone-heavy deals with royalty overlays. Co-development carveouts will remain common as buyers are risk-sizing near term cash outflows while sellers want to retain upside. That changes how innovation is financed and how early-stage companies plan exits.

7. Regulatory & antitrust scrutiny heightens

Large strategic buys in concentrated categories like CNS, obesity, oncology will attract regulator attention, especially where vertical integration (drug + diagnostics + service) could raise market power concerns.

8. Private markets and SPAC/IPO windows

The willingness of big pharmas to pay up depends on where private valuations sit. If VC checks remain cautious, expect fewer sellers and a premium on later-stage assets which can push more companies to partner than to sell outright.

Final Thought

2025 didn’t give us a frenzy of transactions, but it gave us a blueprint. The year’s biggest and most strategic deals suggested that the next era of pharma competition will be built on modalities, precision, and platform scalability. If 2025 was about picking strong positions, 2026 will be about defending them and deciding which scientific bets actually deserve the next round of capital.