Nov 14 2025

/

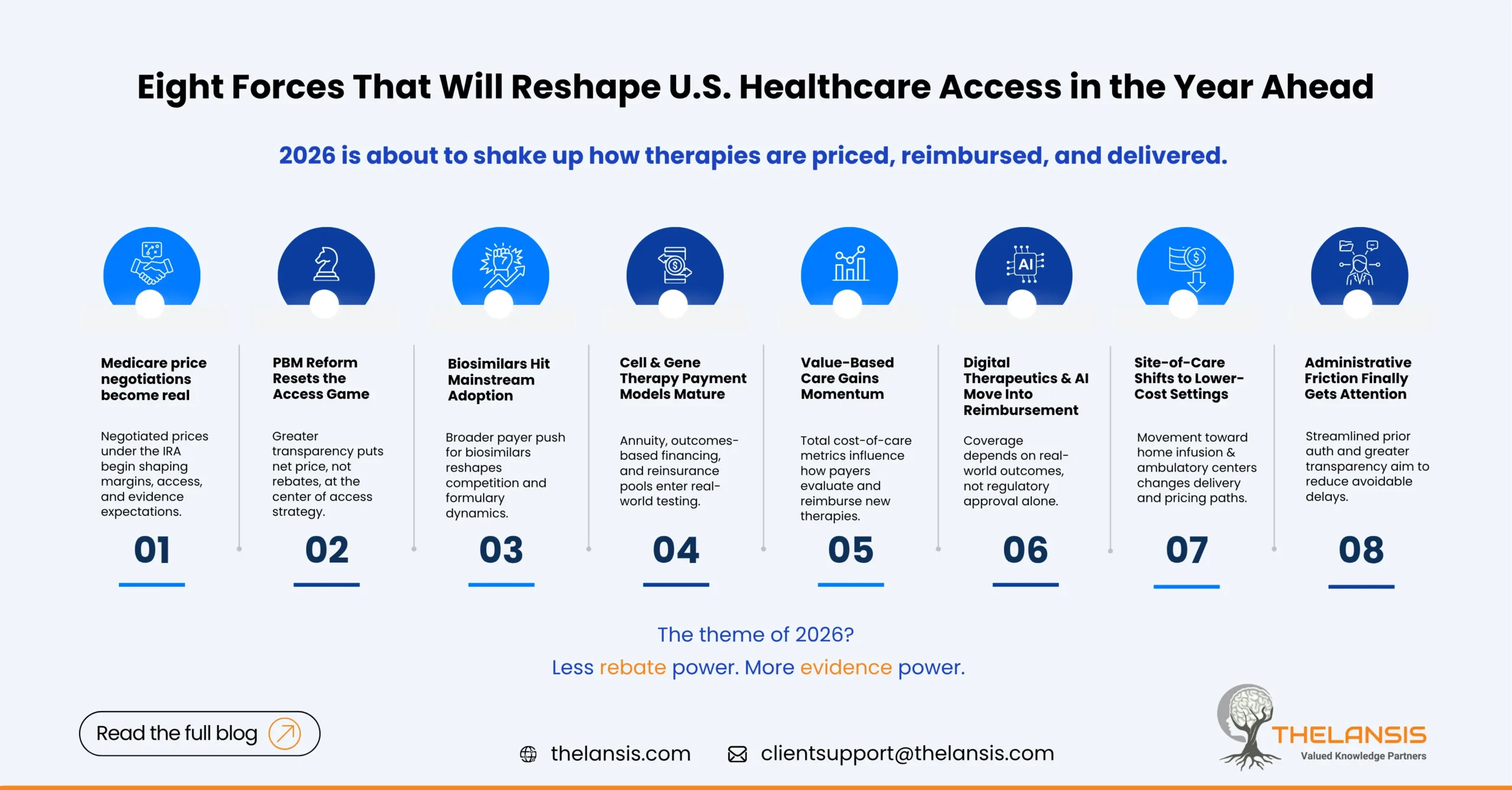

Eight Emerging U.S. Medical Cost & Access Drivers to Watch in 2026

The U.S. healthcare system never really sits still but 2026 is shaping up to be a year where cost, access, and innovation intersect in new and sometimes uncomfortable ways. From the Inflation Reduction Act’s pricing negotiations to the quiet but powerful spread of value-based models, the rules that govern how therapies reach patients are being rewritten.

Below are eight themes we believe will define the next phase of U.S. market access and each carrying very real implications for patients, payers, providers and drug/biotech innovators.

1. Medicare price negotiations move from theory to practice

The Inflation Reduction Act (IRA) has already changed boardroom conversations around pricing and lifecycle management, but in 2026 the negotiated prices will finally start taking effect. Manufacturers will face tighter margins on some of their most commercially critical assets.

For patients, this could mean lower out-of-pocket costs on selected drugs, but also narrower formularies or step edits. Payers will gain leverage to push cost-sharing reforms deeper into commercial plans. And for innovators, it’s a new era of evidence pressure — not just “does the drug work,” but “is it worth it at this price over time?”

The play for pharma: Build long-term value dossiers early. Companies that demonstrate avoided hospitalizations, caregiver impact, or long-term cost offsets will be better positioned when price renegotiations come around.

2. PBM reform: transparency finally arrives with side effects

Pharmacy Benefit Managers (PBMs) are facing their toughest regulatory climate yet. Between congressional scrutiny, state-level reforms, and lawsuits challenging rebate structures, the opaque world of spread pricing is cracking open.

Payers will need to rewire formularies and margin assumptions; manufacturers will see the power of rebates diminish, shifting the game toward net price and outcomes. For patients, the result could be fairer pharmacy pricing though the transition will be bumpy.

The takeaway: Direct contracting and value-based rebate alternatives will become standard components of access strategy. Manufacturers can’t rely on “rebate muscle” to buy access anymore.

3. Biosimilars finally go mainstream

After years of cautious optimism, 2026 could be the year biosimilars fully assert themselves. Uptake in categories like insulin and oncology has shown that payers are ready to treat biosimilars as genuine cost-saving tools.

Expect payers to push aggressive step therapy and formulary switches; providers to focus on interchangeability logistics; and patients to see more affordable biologic options, assuming communication and adherence support hold up.

The opportunity: For innovators, differentiation shifts from molecule to ecosystem — delivery device, patient support, and data on real-world adherence all become the competitive edge.

4. Gene and cell therapy enter the affordability spotlight

Cure-level therapies have arrived, but their price tags still make actuaries nervous. As more one-time treatments for rare and chronic conditions hit the market, payers are testing annuity payments, reinsurance pools, and outcomes-based financing.

For patients, these models could unlock earlier access to life-changing options, but only if data systems can actually track outcomes over the years. For manufacturers, demonstrating durable benefit and facilitating tracking infrastructure will decide who gets coverage and who doesn’t.

The reality: The science is ahead of the payment models. 2026 will be about closing that gap.

5. Value-based care reshapes the access conversation

As CMS and major commercial plans continue their march toward value-based care, the ground under “fee-for-service” medicine keeps eroding. More provider networks will be measured and paid on the total cost of care, not procedure volume.

That changes the lens through which new therapies are judged. Drugs that reduce hospitalizations or emergency visits will gain favor; those that add cost without measurable benefit will find tougher access pathways.

For innovators: Build your economic story for VBC, not just clinical superiority. Real-world evidence is your new access currency.

6. Digital therapeutics and AI-enabled care gain traction

From mental health apps to AI-driven diagnostics, 2026 will test how well digital health can fit into the reimbursement ecosystem. Early signs from private payers and select Medicaid pilots suggest that digital therapeutics (DTx) will finally find footing, if they can prove sustained outcomes and cost offsets.

Payers will reward solutions that reduce utilization; providers will use AI tools to streamline triage and follow-up; and patients may finally get continuous, affordable care between visits.

Access teams need to evolve: Real-world validation, not regulatory clearance alone, will decide coverage.

7. Site-of-care and delivery economics shift rapidly

A push for site-neutral payment is underway. Payers and regulators are encouraging movement away from hospital outpatient departments toward home infusion or ambulatory centers. For high-cost specialty therapies, this could redefine logistics and pricing.

Hospitals face revenue pressures; payers see cost relief; and manufacturers must build adaptable delivery pathways — infusion at home, specialty pharmacy coordination, and digital monitoring.

Lesson: Access isn’t just about coverage anymore, it’s about where care happens.

8. Administrative friction finally meets reform

Prior authorization, coverage churn, and Medicaid redeterminations have created quiet but significant access barriers. In 2026, new CMS and state-level policies are expected to streamline PA processes and improve transparency in coverage decisions.

Patients will see faster approvals and fewer therapy delays, but manufacturers must prepare for higher documentation standards and data-sharing requirements. Payers will lean on automation and AI adjudication to handle volume.

Access teams should respond: Strengthen patient-support operations and equip HCPs with PA-ready documentation tools.

What This All Means

If 2024 and 2025 were about reacting to new rules, 2026 will be about redesigning access strategies from the ground up.

The industry is shifting from a rebate-driven, formulary-first model to one based on measurable outcomes, transparency, and affordability.

- For patients, that could mean a more predictable cost landscape

- For payers, tighter alignment between spend and value

- And for innovators, a new set of skills combining health economics, policy foresight, and operational precision

Bottom Line:

Access in the U.S. is no longer just about price; it’s about proof. Proof of value, proof of impact, proof that a therapy fits within a care model that patients and payers can sustain.

The companies that treat market access as a strategic function and not a post-launch firefight will define the winners in 2026 and beyond.