Jan 30 2026

/

CGT Commercialisation 2.0: Ranking Markets by Regulatory, Infrastructure & Reimbursement Readiness

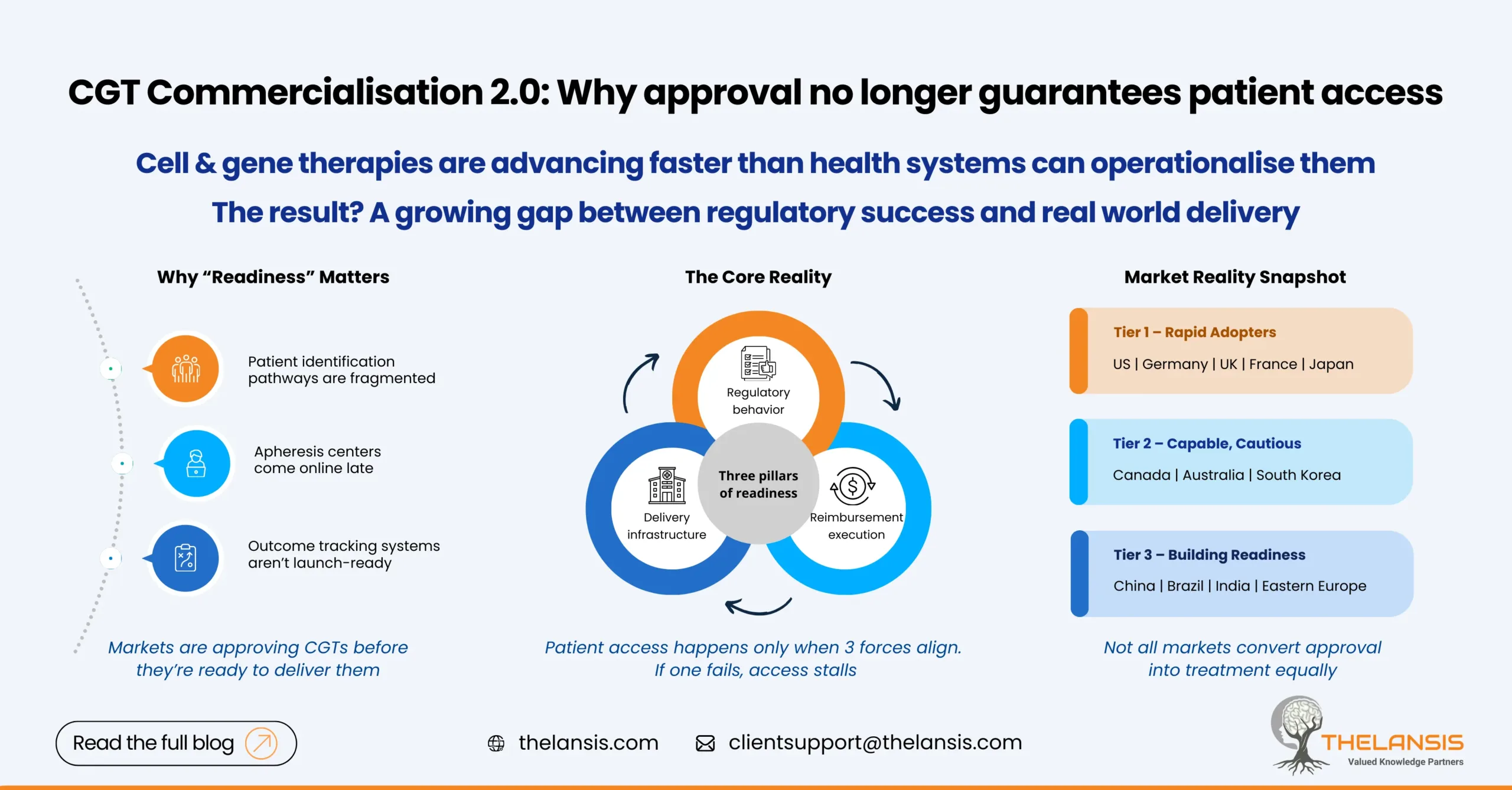

Cell and gene therapies are no longer a niche category. With more approvals coming through, payers pushing back harder, and health systems struggling to keep up operationally, CGT commercialisation has entered a very different phase.

For investors, manufacturers, and global launch teams, the question is no longer where science is strongest, but where patients can actually access therapy. That comes down to three practical levers: how regulators behave, whether systems can deliver treatment, and how willing payers are to fund it.

Why a “Readiness Index” Matters

The 2024-25 period marked a clear inflection point. Regulatory agencies in mature markets moved faster, while a growing number of advanced therapy medicinal products (ATMPs) transitioned from trials into commercial planning. At the same time, cracks became visible.

Approvals alone stopped being a reliable indicator of access. In several markets, therapies were authorized before hospitals were equipped to deliver them or reimbursement pathways were clearly defined. Distribution complexity, workforce constraints, and payment models emerged as limiting factors.

A CGT Readiness Index, therefore, is not about ranking regulators. It is a comparative approach to assess where regulatory speed, delivery capability, and payer execution come together to support real-world access.

The Three Pillars of Readiness:

1. Regulatory agility

Markets differ sharply in how they handle uncertainty. Jurisdictions with clear CGT-specific guidance and adaptive pathways reduce timing risk for sponsors. Japan’s PMDA, for example, has formalized conditional and time-limited approvals that allow earlier market entry while evidence matures, a meaningful advantage for CGTs with evolving datasets.

2. Manufacturing and clinical infrastructure

Access breaks down quickly without physical capacity. Local GMP availability, cell processing centers, trained clinical teams, and reliable cold-chain logistics are essential. Even in markets with strong payer intent, treatment cannot scale if hospitals lack experience or throughput. The U.S. and parts of Western Europe remain ahead, while gaps are widening elsewhere.

3. Reimbursement and payer readiness

High-cost, one-time therapies test traditional payment systems. Markets that experiment with outcome-based agreements or annuity-style payments are better positioned, but execution remains uneven. NHS England and a handful of European systems have shown what is possible, though implementation still lags policy intent in many cases.

Where Launch Plans Often Fall Short

Many CGT strategies underestimate the gap between approval and delivery. Markets may appear ready on paper, yet struggle in practice. Apheresis centers come online late, patient identification pathways are fragmented, or outcome tracking systems required for value-based contracts are not operational at launch.

Readiness is not static. It changes year to year and needs to be reassessed continuously, not locked in at the time of filing.

Practical Market View:

Tier 1: Rapid adopters

United States, Germany, United Kingdom, France, Japan

Strong regulators, established hospital ecosystems, and early reimbursement pilots make these markets the most viable for first-wave launches.

Tier 2: Capable but cautious

Canada, Australia, South Korea

Solid regulatory and clinical foundations, but smaller payer markets or more conservative pricing environments slow uptake.

Tier 3: Building readiness

China, Brazil, India, parts of Eastern Europe

Trial activity and regulatory modernization are accelerating, but infrastructure gaps and fragmented reimbursement limit near-term access.

Who Should Use This Lens

- Global launch teams deciding wave-1 versus wave-2 markets

- BD and licensing teams assessing the geographic value of assets

- Manufacturing leaders aligning capacity expansion with demand

- Investors pressure-testing time-to-revenue assumptions

How to Apply It

The index is most useful when tied to investment decisions. Tier-1 markets warrant early filings and site training. Tier-2 markets benefit from manufacturing partnerships and real-world evidence strategies. Tier-3 markets require longer-term capacity-building and payer-engagement pilots.

Three indicators matter most: regulatory lead time, GMP capacity per capita, and the presence of formal CGT reimbursement mechanisms.

Bottom Line

CGT commercialisation is no longer a straight line from approval to sales. It is sequential: regulation enables entry, infrastructure enables delivery, and reimbursement enables scale.

Markets where these elements align convert investment into access quickly. Where they don’t, even approved therapies can take years to reach patients.

Looking ahead, countries that combine patient registries, digital outcome capture, and flexible manufacturing networks will move fastest. In CGT, readiness will increasingly be defined not just by policy, but by how well systems connect data, delivery, and payment.