Jan 21 2026

/

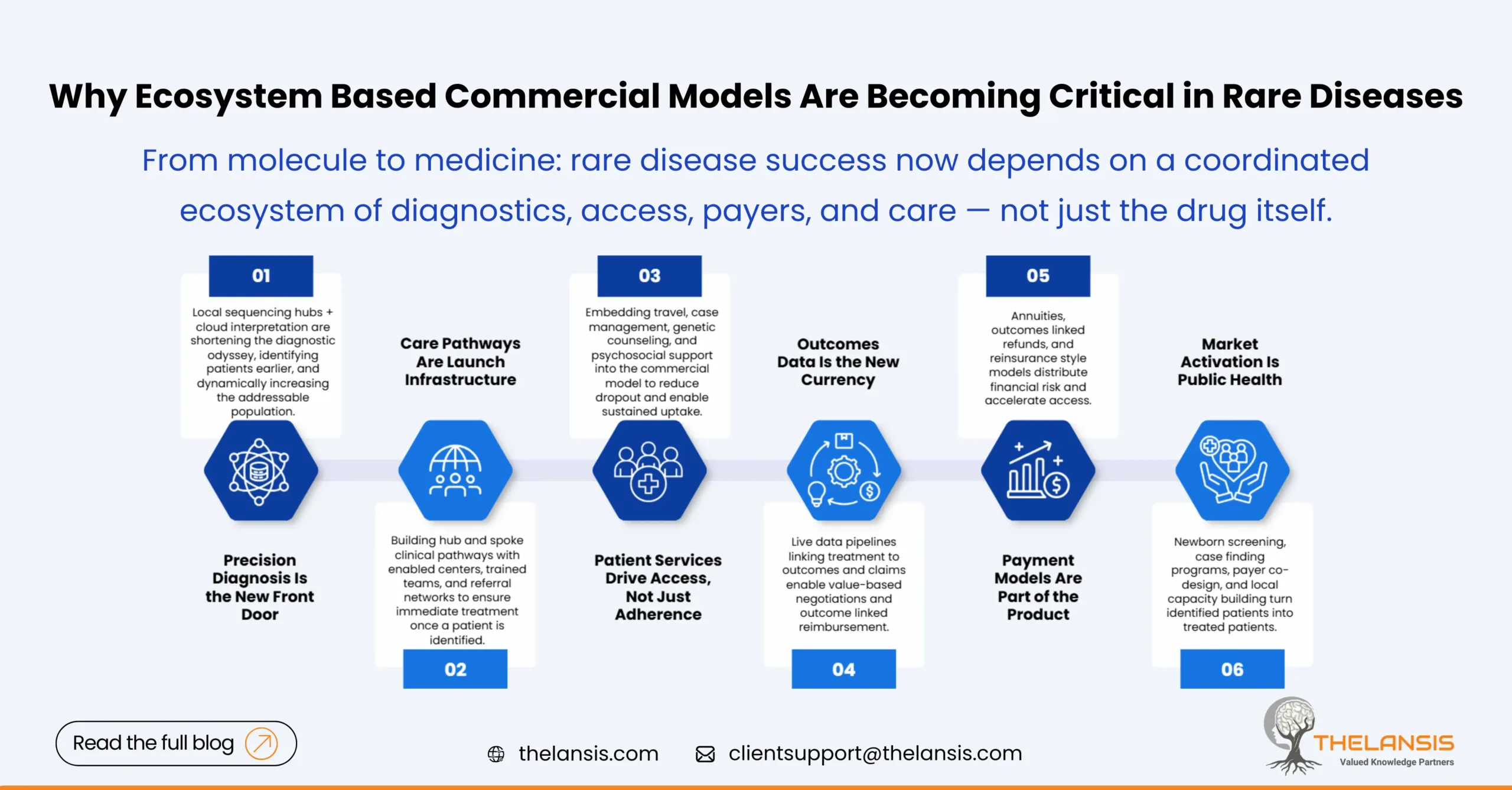

Beyond the Drug: Why Ecosystem Based Commercial Models Are Becoming Critical in Rare Diseases

The quiet truth about rare disease medicines is that a brilliant molecule or a one-time gene therapy is only the opening act. Getting the drug from a lab bench miracle into durable, equitable patient benefit now depends on an orchestra of services, diagnostics, payers, and delivery models that work together— an ecosystem, not a product. In this blog, we will walk through why commercial strategy in rare disease is shifting from “sell the drug” to “design the care pathway,” and what that means for launches, payers, and patients.

The problem that pushed the shift: scale ≠ standard playbook

Rare diseases are heterogeneous by definition, but they share two commercial hard facts: tiny treated populations and, increasingly, very high per-patient costs. An extreme example is one-time gene therapies: pricing can run into the millions of dollars per patient, creating a mismatch with legacy reimbursement systems designed for recurring, lower-cost drugs. These economics force companies and payers to rethink not only value, but how care is identified, delivered and measured.

When the “unit” you sell is a lifetime outcome for a handful of patients per country, the questions aren’t just clinical efficacy; they are logistics, diagnostics, outcome measurement, and payer risk allocation.

What the ecosystem looks like and why each piece matters

An ecosystem-based commercial model brings together at minimum: advanced diagnostics (often genomic), specialist treatment centers, patient-facing wraparound services, data pipelines for real-world outcomes, and flexible payment arrangements. These aren’t optional add-ons, but prerequisites for access and sustained uptake.

Decentralized diagnostics and sequencing networks: Faster diagnosis shortens the “diagnostic odyssey” and increases the eligible population who can benefit, often by catching disease earlier, when therapies are most effective. New models, local sequencing hubs combined with cloud-based interpretation, are reducing turnaround and spreading capability beyond a handful of centers. This is changing the addressable market in real time.

Specialist centers + hub and spoke care: Many rare therapies require specialized infusion suites, gene-therapy trained nursing, or multidisciplinary follow-up. Commercial teams must map and enable clinical hubs (and their referral networks) well before launch.

Patient services as commercial infrastructure: Travel assistance, case management, genetic counseling and psychosocial support aren’t just compassionate, they’re access drivers. For ultra-rare conditions especially, these services materially reduce dropout and enable retention in registries and follow up studies.

Real-world evidence (RWE) and outcomes monitoring platforms: Payers increasingly demand outcomes data for value confirmation. Manufacturers that build live data flows, linking treatment events to clinical outcomes and claims, gain negotiating leverage and can design outcome-based contracts.

Innovative payment and risk-sharing models: When a single dose can cost millions, payers push for creative approaches: annuities, outcomes-based refunds, or reinsurance-style models that distribute risk over time or across populations. These financial tools are becoming part of the product offering, not an afterthought.

Ultra-niche launches: from geography to pathway activation

Ultra-niche doesn’t only mean few patients; it means that market activation depends on non-traditional levers. A successful launch today often looks less like a pharma rep campaign and more like a public health activation:

- Work with newborn screening programs or targeted case finding initiatives to identify infants at birth

- Partner with payers and health systems to pre-design coverage pathways and data sharing

- Invest in local capacity building (labs, specialty centers) so that an identified patient can be treated immediately

The playbook from classical launches: mass promotion, large physician networks, and formulary placement, still matters in a supporting role, but the heavy lifting is in creating the pathways that turn identified patients into treated patients.

Payer readiness: adapt or restrict

Payers control access. Historically, payers reacted to unique high-cost therapies on a case-by-case basis; now many are proactively building frameworks for cell and gene therapies and other complex rare disease treatments. Expect to see more:

- National or regional outcome-based agreements that link payment to real-world patient benefit

- Pharmacoeconomic assessments adapted to single or few patient cohorts

- Use of reinsurance, budget caps, or special funds for ultra-expensive one-time treatments

Manufacturers that approach payers with transparent outcomes plans, registry commitments, and concrete patient identification strategies find faster pathways to coverage than those who bring price alone to the table. Examples of outcome-linked reimbursement for high-cost gene therapies have already been piloted and are expanding globally.

Why this is good news for patients (and for smart companies)

Yes, the commercial picture is more complex but the upside is meaningful. An ecosystem approach reduces time to diagnosis, improves clinical outcomes through earlier intervention, and can spread the fiscal burden in ways payers will accept. For manufacturers, integrated commercial models build defensibility: they turn a drug into a care pathway solution that’s harder for competitors to replicate quickly.

Concrete wins are already visible in programs that pair newborn genomic screening pilots with rapid treatment pathways, detecting actionable conditions sooner and enabling interventions that can change life trajectories. Public–private collaboration in these pilots is a working template for the future.

Practical implications for commercial leaders

If you’re building a rare disease commercial plan today, treat these as non-negotiable line items:

- Invest in diagnostics early and not later. If patients can’t be found, no amount of KOL support will create demand

- Design outcomes data capture from day one. Registries and digital platforms are table stakes in payer negotiations

- Map and fund patient services as part of launch costs: travel, counseling, and case management materially affect uptake

- Engage payers and health systems pre-launch to co-create payment models; ideation post-approval is often too late

- Pilot pragmatic delivery models (hub and spoke, decentralized sequencing) regionally and scale what works

Final thought

Rare disease commercialization has matured: the question is no longer whether the molecule works, but whether the healthcare ecosystem can find, treat, and measure benefit for the patient. Those who design the full pathway from diagnostics, logistics, patient support, data, to payment will turn scientific breakthroughs into durable health outcomes.

In rare diseases, the value truly lies beyond the drug.